Ethereum: Can I Sell Items on Etsy Using Bitcoin?

When it comes to selling digital and physical goods on platforms like Etsy, many crafters and makers have wondered if it’s possible to use the cryptocurrency Ethereum to fund their business. In this article, we’ll delve into the world of Ethereum, Bitcoin, and Etsy to explore whether you can sell items on the platform using these two technologies.

What is Ethereum?

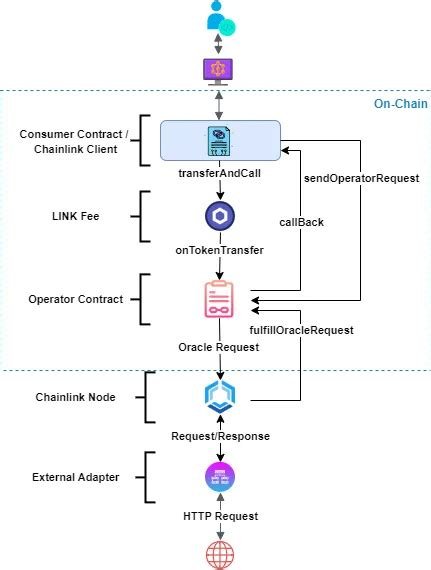

Ethereum (ETH) is a decentralized, open-source blockchain technology that enables the creation of smart contracts and decentralized applications (dApps). It allows users to store, send, and verify cryptocurrency transactions without the need for intermediaries. Ethereum’s use cases include non-fungible tokens (NFTs), decentralized finance (DeFi) protocols, gaming, and more.

What is Bitcoin?

Bitcoin (BTC) is the first and most well-known cryptocurrency, launched in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. Bitcoin is a limited supply of 21 million coins that uses cryptography to secure and verify transactions on the blockchain.

Can I sell items on Etsy using Ethereum?

Etsy is primarily a marketplace for physical goods, such as handmade crafts, art, and second-hand items. However, some sellers have experimented with using Ethereum to fund their business or receive payment in alternative ways. Here are a few ways you can potentially use Ethereum to sell items on Etsy:

- Payment gateway integration: You can integrate the Ethereum payment gateway, MetaMask, into your Etsy shop to accept Bitcoin payments.

- Ethereum-based digital products: You can create and sell digital products, such as printable art or digital files, using blockchain-based platforms like OpenSea or Rarible.

However, there are some limitations and considerations:

- Commission fees: Using Ethereum payment gateways have incur additional commission fees compared to traditional payment methods.

- Security concerns

: Bitcoin transactions on the Ethereum network can be more vulnerable to hacking and theft due to its decentralized nature.

- Etsy’s policies: As of now, Etsy doesn’t explicitly allow using Ethereum as a primary payment method or for selling physical goods. They do accept some cryptocurrencies, like Bitcoin, but with restrictions.

Can I sell items on Etsy using Bitcoin?

The short answer is: yes, you can use Bitcoin to fund your Etsy shop. However, it’s essential to be aware of the limitations and potential risks involved:

- Etsy’s cryptocurrency policy: As mentioned earlier, Etsy does allow accepting cryptocurrencies like Bitcoin as payment methods for certain sellers.

- Compliance with laws and regulations: Ensure that using Bitcoin in your business complies with all applicable laws and regulations regarding financial transactions.

Will Etsy freeze my account?

It’s unlikely that your Etsy account will be frozen due to using Bitcoin, but there are a few scenarios where it might occur:

- Compliance issues: If you’re selling physical goods on Etsy, they might ask about the cryptocurrency payment method during the checkout process.

- Security concerns: If you’re using MetaMask or another Ethereum-based payment gateway, Etsy might require additional security measures to ensure compliance with their policies.

Tips for successful Bitcoin and Ethereum business on Etsy

To maximize your chances of success selling items on Etsy using Bitcoin or Ethereum:

- Research and understand the platforms: Familiarize yourself with both Ethereum and Bitcoin ecosystems, including fees, payment gateways, and security considerations.

- Comply with laws and regulations: Ensure you’re meeting all applicable financial transaction laws and regulations in your business.

3.